2.75%

AER

Term

Germany

(AAA)

Fixed interest rate

No withholding tax

In an advancing digital world, digital money is also playing an increasingly important role. This is why the European Central Bank (ECB) has been working on the Digital Euro Project since October 2021. The digital euro is intended to offer the advantages of cash in digital form. These include availability throughout Europe and security and privacy when making payments.

Digital currency, or digital money, is a payment method that can exclusively be used in electronic form. In contrast to cash money which consists of bank notes and coins, digital money is not physically palpable.

Generally, digital money represents so-called fiat currencies. Fiat currency or money is not backed by a commodity such as gold or silver. Most modern paper currencies like dollars and euros are fiat currencies. Digital money can be exchanged via computers, smartphones, cards, or online cryptocurrency exchanges. It is also possible to convert digital currency into physical cash using an ATM, but only in some cases. Some examples for types of digital money are central bank digital currencies, cryptocurrencies, and stablecoins.

A central bank digital currency (CBDC) is one type of digital currency which is issued by a country’s central bank. For example the central bank for the eurozone is the ECB (European Central Bank). It is responsible for all the euro currency.

The CBDC is very similar to other digital money like cryptocurrencies, except its value is fixed by the central bank and it is always an equivalent to the country’s fiat currency. Some important purposes of CBDCs are:

The concept and use of digital money is very similar to its cash counterpart. Both can be a unit of account and a medium of daily transactions. If you want to make a payment, cash and digital money can be treated the same. Digital currency works by using computers to store and transfer money electronically. Instead of physical cash, digital money exists only online. Transactions are verified by many computers in a network, which ensures the money is real and can’t be copied. Some digital currencies, like Bitcoin, use special technology called blockchain to track and secure transactions without needing banks or governments.

According to the ECB, the digital euro would be a form of cash, issued by the central bank and available to everyone in the euro area. If implemented, it can be used for any electronic payments in shops, online or from person to person. A digital euro would be free of charge and you could use it anywhere in the euro area just like cash. As our society is becoming more digital every year, the European Central Bank believes that this is the next logical step for the euro currency.

In comparison, a digital euro would not be very different from what you are used to with cash money. For example, when you withdraw some money from an ATM, the balance of your bank account goes down by the desired amount. As a result, you now have the money withdrawn as cash. The process is very similar to a digital euro. The only difference is that the money would not be converted into cash but digital money.

Here is a step-by-step explanation of how a digital euro would work:

On their website, the European Central Bank introduces the most important key features of a digital euro:

Our society is becoming more digital every year. The same is true for chosen payment methods. Many people prefer to pay electronically rather than with cash. This is the reason why the ECB is investigating the possibilities of a digital euro in the eurosystem that would be used alongside cash. According to them, there are many benefits that come with a universally accepted digital euro. The two main aspects are the financial innovation and the importance of central bank money.

Financial innovation is based on the fact that many aspects of our daily lives are becoming more digitalised. As a consequence, the ECB believes it’s time to ensure that our currency must also evolve to match people’s payment preferences. However, it is important to note that they do not want to get rid of cash but rather provide both a digital euro and cash money. A digital euro would also bring privacy and inclusivity in the digital era just like cash. Further, it’s intended to make our lives easier by providing an additional means of payment that is free of charge and can be used everywhere in the euro area. Lastly, the digital euro would strengthen Europe and make the euro area more robust. A digital euro would not only support the EU’s monetary sovereignty, but also make the payment landscape more competitive and resilient.

A second benefit of a digital euro is the possibility to grant access to central bank money in a digital form. At the moment, cash is the only form of central bank money – money that is created at the ECB – that is available to the public. It is also called public money because it is issued by a public institution. In contrast to this, there is private money that is created by commercial banks. For example, when you get a loan from a commercial bank, the money that appears on your bank statement is private money. This also includes the balance on your bank account and all payments you make with your debit or credit card. By providing a digital euro, the ECB aims to combine the benefits of central bank money with today’s commonly used payment methods.

The digital euro project was first launched in October 2021. The first phase of the project was a two-year investigation to explore the technical and policy options that could form the basis of a digital euro concept. The main focus of the investigation was to elaborate how a digital euro could be used both by companies and citizens and what the impact on European society and economy may be.

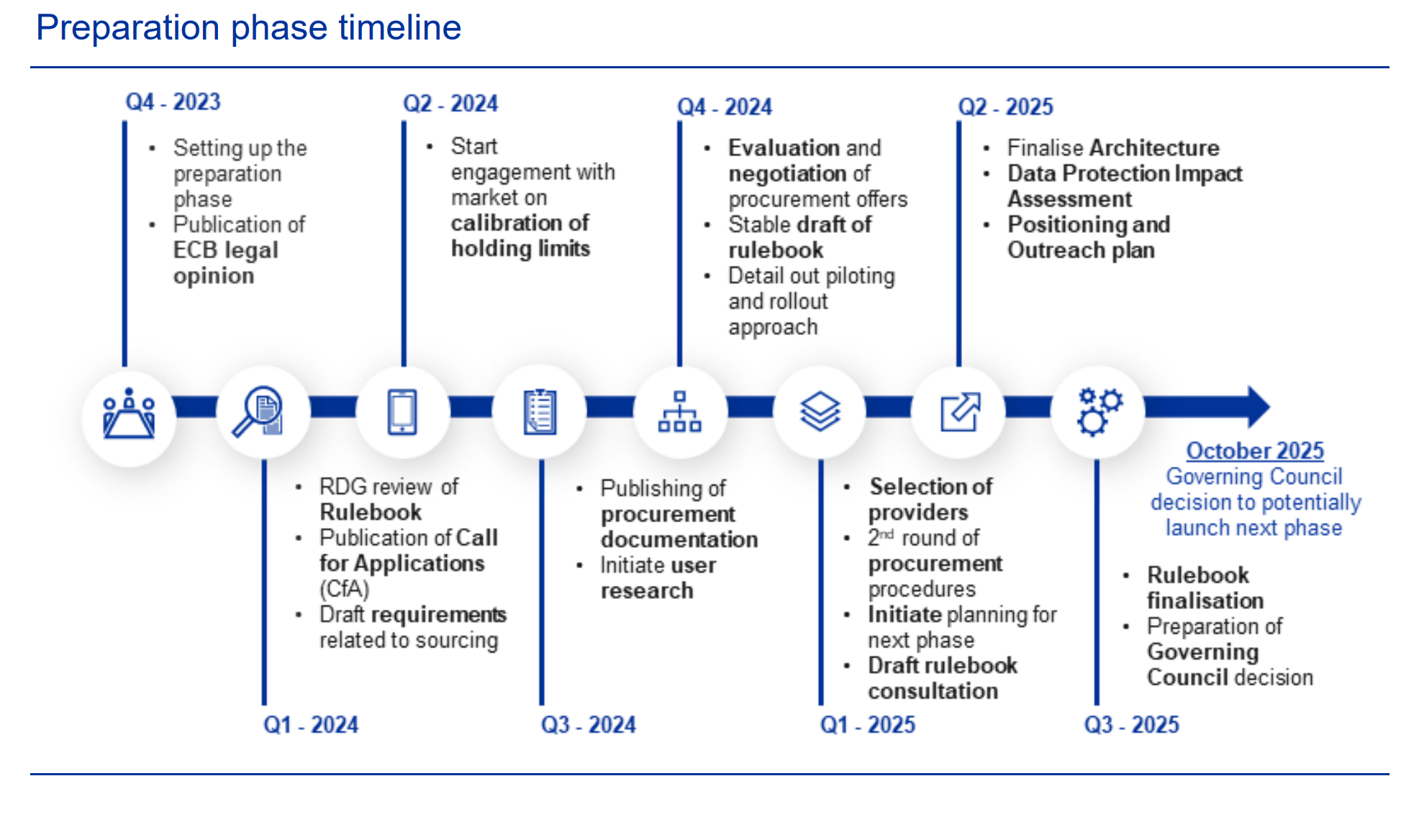

In October 2023, the Governing Council of the European Central Bank moved to the next phase of the project. The preparation phase officially commenced on 1 November 2023 and is planned to continue for two years until October 2025. Some of the key aspects of the preparation phase will be:

The ECB will publish any progress throughout the preparation in regular reports. A set timeline for all the tasks has been published in their first report at the beginning of the preparation phase:

There is no guarantee that a digital euro will be issued in the future. The decision will be considered by the Governing Council when the EU’s legislative process has been completed. Until then, the ECB will decide in October 2025 if they are ready to move to the next phase of the project.