Should I put my money in savings or pay off my mortgage?

Homeowners sometimes have the opportunity to consider whether you should pay off a mortgage early or grow savings instead. Both options have pros and cons that can impact the decision based on someone’s financial situation or other financial goals. On this page, you’ll discover the benefits of paying off a mortgage early, whether it’s better to put your money in savings, and tips to make an informed decision.

When deciding whether to pay off your mortgage or save, consider interest rates

It's important to check your mortgage agreement, as some banks charge a fee if you overpay too much

You may want to prioritise paying off other debts first

Is it better to put money in savings or pay off my mortgage?

Whether you should pay off your mortgage or save largely depends on your current financial needs and situation. One thing you can do is to consider the interest rates involved. If the mortgage interest rate is higher than the interest rate on your savings account, prioritize mortgage repayment, since you are ultimately paying more to have that debt than you would earn through interest. But, if the reverse is true, and a savings account offers a higher interest rate than the mortgage you’re paying, putting extra money into savings might be a better option.

What are the benefits of paying off my mortgage early?

It’s important to note the advantages and disadvantages of paying off your mortgage early. Your mortgage is likely your most substantial debt, spanning several years, and accumulating significant interest. Paying it off early can reduce your overall monthly payments. However, it’s important to weigh this decision against other debts you may have.

To make an informed choice, try our user-friendly budget planner that can help you decide whether to pay off your mortgage early or save instead. Evaluate the pros and cons based on your specific case and take control of your mortgage repayment plan.

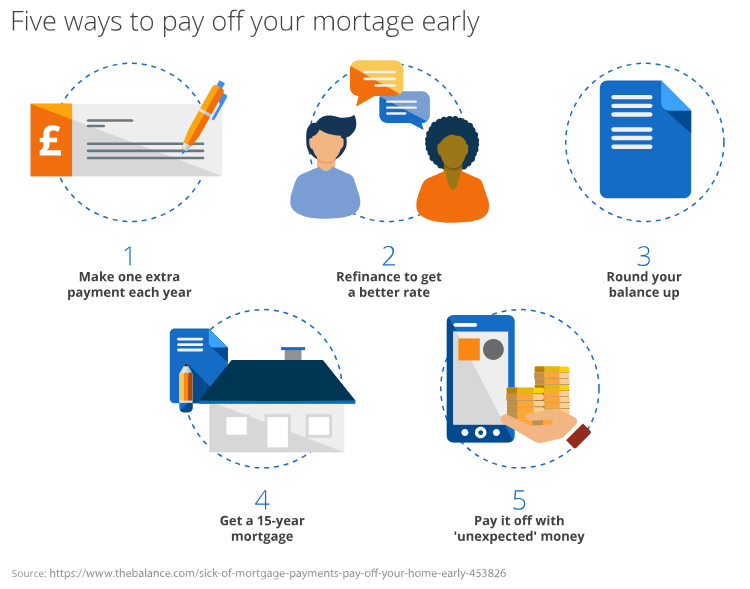

How to pay off your mortgage early

If you’re asking yourself, “should I pay off my mortgage early?”, here are some simple ways to help you make a decision:

- Can you make extra payments on a regular basis?

- Can you refinance the mortgage to get a better interest rate?

- Can you use a shorter-term mortgage to reduce your time in debt?

- If you have a lump sum saved, would that pay off a sizable amount?

- Can you afford to use an annual bonus or inheritance to pay off your mortgage?

At what age should I pay off my mortgage?

Many people strive to pay off their mortgage in their fifties so they can contribute more towards their pension before retirement. However, this goal might be becoming increasingly difficult due to rising house prices and cost-sharing with a partner or family member.

If you find yourself paying off your mortgage during retirement, you can consider other options. For instance, interest-only mortgages give you some disposable income while still allowing you to meet your mortgage payments.

Should I use my savings to pay off my mortgage?

If your savings aren’t earning much interest, it may be better to use them to pay off a mortgage that is accruing interest. However, if your savings are in high-interest rate savings accounts like high yield savings accounts or savings bonds, you might want to prioritize long-term growth.

Paying off your mortgage early can free up funds for savings and retirement. If, in case, you’re planning to use up your savings for mortgage repayment in the future, you can consider doing it now instead. This way you can pay off your mortgage sooner. But, remember to maintain a balance of three to six months’ worth of savings for emergencies.

Can I use my pension to pay off my mortgage early?

Using your pension to pay off your mortgage can be a good option, especially if you’re already retired. This is particularly helpful if you have an outstanding interest-only mortgage with no means to settle the remaining balance.

If you decide to use your pension for mortgage repayment, it’s almost the same as using your savings. So, you should be careful and make an informed decision to avoid making a bigger dent than expected. It’s a good idea to ensure you have sufficient funds to live on.

What are the benefits of saving vs. paying off my mortgage?

It can be a challenge to build savings when interest rates are low. In such cases, overpaying on your mortgage may be more helpful so you can pay off your home sooner. However, make sure to review the terms of your mortgage agreement, as overpaying can lead to penalties.

If the interest rate on your savings surpasses the interest rate on your mortgage, it might be better to contribute more to savings. The next step is to consider what type of savings account suits your needs. For instance, high yield savings accounts and savings bonds generally offer competitive interest rates on lump sum deposits.

Regardless of the savings account you choose, having an emergency fund helps you prepare for unexpected events. An emergency fund may have varying levels of accessibility. For instance, demand deposit accounts offer more flexibility, making it quick and easy to access your funds when needed.

How do I know if saving or overpaying my mortgage is better for me?

Deciding between saving or overpaying on mortgage depends on several factors. Some of these factors are outstanding debts with high interest rates, the availability or accessibility of an emergency fund, and your family’s financial security if something happens to you.

Here are some important questions to consider when deciding between saving or overpaying on mortgage:

- Can you overpay on your mortgage without incurring penalties?

- Do you have outstanding debts with high interest rates?

- Have you established an emergency fund to cover unexpected expenses?

- Are you earning a competitive interest rate on your savings?

- Are you saving into a pension?

- Do you have dependents who might face financial challenges if something happens to you or your income?

- Do you have a flexible or offset mortgage that offers greater financial flexibility?

Is it better to overpay mortgage monthly or lump sum?

If you decide to overpay on your mortgage, you might have to choose between monthly or lump sum payments. Both options have their pros and cons. Mortgage overpayment done monthly is easy to track and you have the option to factor it into your monthly budget. You can stop these payments anytime you want. Alternatively, a lump sum payment helps you save money on interest. But, once paid, you might not be able to access this money again so make sure you have enough saved for emergencies.

Should I pay off my mortgage or save for retirement?

You may even want to think about paying off your mortgage early or saving for retirement. Even though this depends on individual circumstances, saving for your retirement as early as possible is often beneficial.

By investing in your pension, you can take advantage of compound interest. The earlier you begin saving, the more time your funds have to grow, potentially leading to high returns for your retirement.