It won’t come as a surprise to anyone that life is more expensive when you don’t have someone to split the bills with, but ahead of Valentine’s Day, new data by Irish savings platform Raisin Bank has revealed exactly how much singles would need to earn in order to have the same lifestyle as couples.

- The number of people in Ireland who are single is steadily increasing, with the percentage rising to 41% in 2022 (with more men than women single, at 52/48%)

- While the gender pay gap has been well documented in Europe, another financial disparity has emerged: the relationship finance gap, where singles need to earn €82,800 to afford the same lifestyle as the average couple

- With singles shelling out more than €2,300 a month on general expenses such as housing and bills, we calculate that they would have to find an extra €10,584 a year in order to bridge the gap with couples

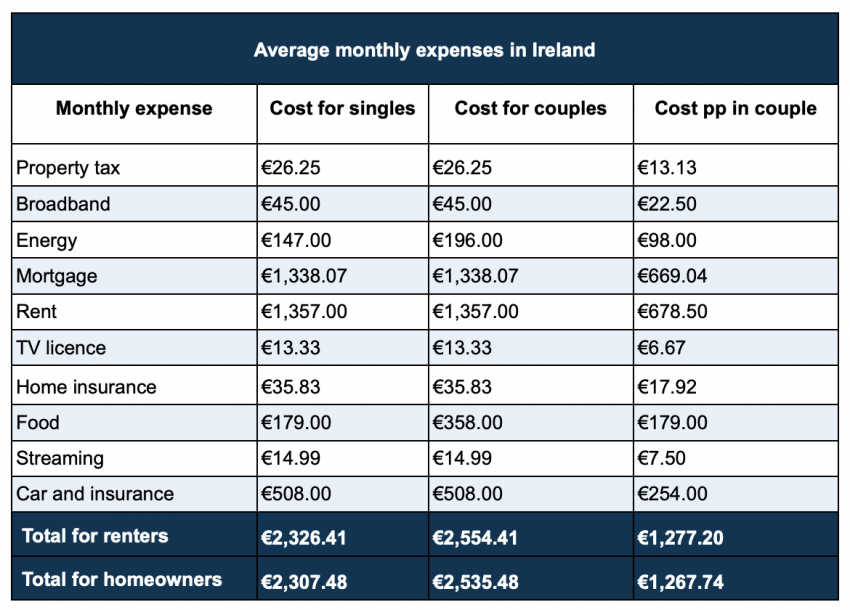

While not everyone aspires to the picket-fence lifestyle, many do, so we looked at exactly how much it would cost to have a mortgage on a two-bed semi, own a car and have enough money to comfortably follow the 50/30/20 rule (where 50% of your monthly income is spent on essential needs, such as bills, housing and food, 30% is on wants and 20% on savings) for both singles and couples.

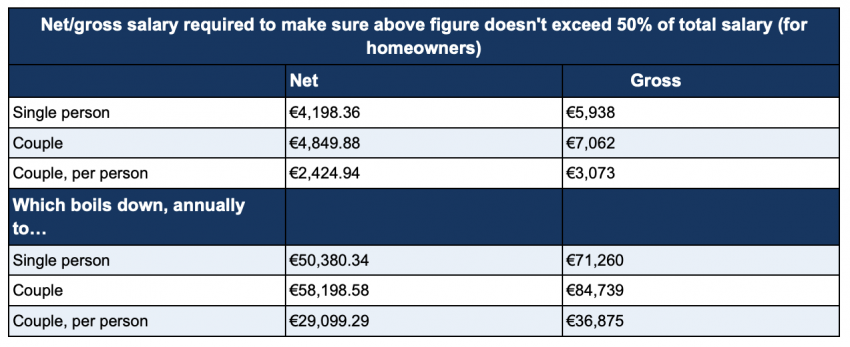

Our data showed that the cost of this average lifestyle works out at €2,307 a month for singles and €2,535 a month for couples, meaning that while couples splitting things down the middle end up paying ‘just’ €1,267 each, singles need to find an extra €1,040 a month in order to keep up with the Joneses.

In order to maintain this lifestyle and follow the 50/30/20 budgeting rule, where unavoidable expenses come to no more than 50% of your net monthly income, singles would need a gross income of €82,800 – well above the Irish median salary of €34,886. Couples, on the other hand, only need a yearly income of €34,980 each to comfortably cover their monthly expenses of €1,234 each – showing it truly pays to be in a relationship.

Of course, securing a mortgage in the first place can be incredibly difficult on one person’s salary, which means single people are more likely to rent than own a home. In 2022, home ownership rates fell as the total number of households living in rental accommodation increased to over half a million. But with private rent averaging €1,357 a month, singles will struggle more than couples to save money and get out of the rent cycle in the first place.

When we looked at the equivalent standard of living for individuals who rent instead of own a two-bedroom semi, the results were similarly bleak. Singles cough up €2,326 per month for rent and bills, while couples share total expenses of €2,554 – only €1,277 each – giving them €1,049 extra a month to spend, invest, or put towards the future.

Monica Pina Alzugaray of Raisin Bank, comments: “These figures paint a stark picture when it comes to how much a single person would need to earn in order to have the type of lifestyle that the average couple can take for granted. With the ongoing cost of living crisis and housing crises, these numbers are unlikely to get much better any time soon. For those who can afford to, savings rates are currently still relatively high, so opening a flexible demand deposit account and topping this up – even only with small amounts, when it’s possible to – can mean your money grows over time, and can help you to feel more positive about the future.”

Austria

Austria

Finland

Finland

France

France

Germany

Germany

Ireland

Ireland

Netherlands

Netherlands

Poland

Poland

Spain

Spain

United Kingdom

United Kingdom

United States

United States

Other (EU)

Other (EU)