What is the 50/30/20 rule, and how does it work?

Are you struggling to save money or not sure where to start? The 50/30/20 rule can help you manage your finances efficiently and boost your savings. On this page, we’ll explain what the 50/30/20 budgeting rule is, how it works, and how you can put it into practice.

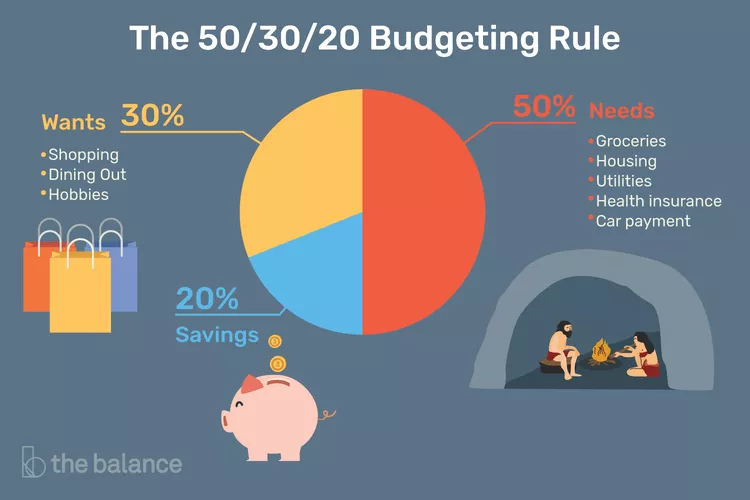

Prioritise your spending: In the 50/30/20 rule, 50% of your after-tax income goes to needs, 30% to wants, and 20% to financial goals, such as saving or paying off debt

Using the 50/30/20 rule: Check your monthly take-home pay, calculate what you typically spend, and then find ways to cut back if needed to make sure you save 20% of your income

Optimise your savings: Consider setting up automatic savings in a fixed term deposit account to benefit from market-leading interest rates

What is the 50/30/20 rule?

Source: https://www.thebalancemoney.com/the-50-30-20-rule-of-thumb-453922

The 50/30/20 rule is a simple way to manage your after-tax income. First introduced by US senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan”, this rule helps you budget by dividing your take-home pay into three categories: needs, wants, and financial goals.

Here’s how it works:

- 50% for needs: essential expenses like housing, food shopping, and bills.

- 30% for wants: nice-to-have options like dining out, entertainment, and travel.

- 20% for financial goals: savings, investments, and debt repayment.

By following the 50/30/20 rule, you can balance your spending, enjoy some of your hard-earned money, and still save some of your pay cheque to create a more stable financial future.

What’s included in the 50% for needs?

Under the 50/30/20 savings rule, half of your income after taxes should ideally go towards your essential needs, which are things you have to spend money on to live. This includes:

- Rent or mortgage payments.

- Energy bills like gas, water, and electricity.

- Grocery expenses.

- Medicines.

- Transport costs for commuting to work.

- Costs related to a child’s education.

If these expenses are higher than 50% of your income, you could find ways to cut down your monthly expenses or increase your earnings. On the other hand, if your expenses total less than half of your income, you could put anything above the 50% towards savings or wants, depending on your priorities at the time.

What is included in the 30% to cover wants?

The 30% allocation in the 50/30/20 rule is for your wants, i.e. anything that brings enjoyment to your life but isn’t absolutely necessary. These include things like non-essential clothing, dining out, travel, and subscriptions to services like streaming platforms or courses you attend as part of a hobby.

Sometimes, it’s tricky to differentiate between needs and wants, so let’s consider an example. If you buy a new winter coat, ask yourself: could I manage without it? If the answer is yes, it’s a want. Looked at another way, if you buy a coat when you already have several that keep you warm, it falls under your 30% allowance for wants.

What is included in the 20% to cover financial goals?

The 20% portion of the 50/30/20 rule is for stashing away some of your monthly income for the future. You might use this to save, invest, or repay debt. Specifically, it might include paying off debts such as credit cards and student loans, contributing to your pension, and building an emergency fund for unexpected expenses.

Ultimately, this part of the 50/30/20 savings rule is designed to make sure you’re actively working towards building financial stability and any long-term goals you might have, whether that’s saving for retirement, establishing a safety net, or saving for major purchases like a house mortgage.

To ensure you save this amount each month, consider setting up an automatic transfer from your current account to a savings account using a savings plan. This way, you’ll get used to living without that money each month and benefit from the interest on your growing savings.

How do I put the 50/30/20 rule into practice?

Ready to start using the 50/30/20 rule? The next step is to put it into action. With a €2,000 monthly after-tax income, you would set aside €1,000 (50%) for essentials, €600 (30%) for discretionary spending, and €400 for savings or debt repayment.

Let’s take a closer look at this process:

- Start by calculating your after-tax income, including any passive income from property. After-tax income in Ireland is your earnings after income tax, Universal Social Charge (USC), and Pay-Related Social Insurance (PRSI) have been deducted.

- The next step is to look at your typical monthly expenses. You could review your bank statements or transaction history, separating them into needs and wants. Try to include cash spending in this calculation, even if it’s just an estimate.

- The final step is to use the information you’ve calculated in steps one and two to adjust your spending. If your expenses are excessive, you can try to find ways to lower them so that you are able to meet the 20% requirement for savings or paying off any debt.

If you find your expenses are too high, or your income is too low, Raisin Bank has a page full of handy ways you can save money.

What are the pros and cons of the 50/30/20 budgeting method?

Pros:

- Simplified budgeting: The 50/30/20 budget provides an easy-to-follow framework for managing your finances.

- Better financial awareness: By following this budgeting rule, you’ll have a clearer idea of where your money goes each month.

- Flexible approach: Unlike restrictive budgets, the 50/30/20 rule allows you to adjust the percentages to suit your needs.

- Encourages cost reduction: It motivates you to get your fixed expenses down and perhaps lead a more frugal lifestyle.

Cons:

- Lack of personalisation: The 50/30/20 rule may not cater to your personal circumstances or financial goals. For example, if you’re trying to save for a big purchase like a house, the 20% for savings might not be enough, making it unrealistic for such significant savings goals.

- Overemphasis on discretionary spending: Depending on your particular lifestyle, the rule might allocate too much of your income to non-essential expenses, potentially leaving you with less money for important needs or financial goals.

- Not suitable for every situation: This budgeting method might not work for everyone. If your income is very low or highly variable, or if you have high essential expenses, the 50/30/20 rule might not be a practical way to manage your finances.

- If your income is too low, you may need to defer using the 50/30/20 rule, lower the percentage of income you save or learn how to budget on low income.

Does the 50/30/20 rule work?

The 50/30/20 rule is a good starting point for budgeting and can help you get into the habit of saving. It’s easy to calculate and remember, which is a plus. For many, saving money each month can be a struggle, but this rule provides a structured way to meet various savings goals.

It’s not just for short-term savings, either. You can use the 50/30/20 approach for long-term planning by setting aside part of the 20% for future goals like buying a house or investing. This can help you bring more focus to your savings strategy.

However, the 50/30/20 budget is not a one-size-fits-all approach. You might think of it more as a guideline that might not suit everyone’s financial situation perfectly, such as having a variable or low income.

Can I adjust the percentages in the 50/30/20 rule?

Yes, it’s actually encouraged to tailor the percentages to your specific financial situation. This is one of the main advantages of the 50/30/20 rule. If saving 20% of your income feels too much, you can always adjust it. How to budget on low income may look different from budgeting with a higher income. Maybe you could aim for 10% or 5% monthly. You could even try out different ratios for a few months and then revert to the original ratio - it’s not set in stone.

Considering the rising cost of living in Ireland and elsewhere, many people find their salary increasingly swallowed up by household bills and other expenses. In Ireland, rent alone often absorbs around 30% of income, while other costs can push this beyond 50%. You might need to allocate up to 70% towards needs, rather than sticking strictly to the 50/30/20 budget percentages.

How much should I save every month in Ireland?

The amount you should save each month depends on your financial goals. In general, following the 50/30/20 rule suggests that you save 20% of your after-tax income each month.

However, in Ireland, the cost of living, especially for rent and household bills, can be high. If your essential expenses take up a larger portion of your income, you may need to adjust this percentage.

A good starting point is to aim for at least 10-20% of your monthly income, and if possible, increase it over time as your financial situation improves. If you're saving for a specific goal, like buying a home, you might want to consider saving a larger portion of your income.

Using the 20% savings to build an emergency fund

Do you have some money stashed away for a rainy day? With the 50/30/20 rule, you can put part of the 20% towards creating an emergency fund. Experts generally advise having enough saved up to cover three to six months of living expenses. This way, you’re prepared for unexpected costs like car repairs or sudden unemployment, without resorting to credit cards or loans, or draining your savings.

What should I do with my savings?

If you're following the 50/30/20 rule, putting a portion of your monthly income into a fixed term deposit account is an easy way to meet your savings goals. Fixed term deposits have several benefits, including guaranteed returns and protection from interest rate changes. Raisin Bank offers some of the most competitive rates in Ireland and Europe, ensuring that you get the most from your savings.