2.75%

AER

Term

Germany

(AAA)

Fixed interest rate

No withholding tax

Global uncertainty remains high. While the U.S. has paused new tariffs, markets continue to react to shifting policies, interest rate movements, and a slowing global economy. At the same time, Irish banks continue to offer some of the lowest deposit rates in Europe. If you have money to invest or save, it’s more important than ever to think about diversification. Smart, secure savings options can play a valuable role — and they’re closer than you think.

Ongoing global volatility, including shifting U.S. trade policy and economic uncertainty, continues to affect Irish savers

Meanwhile, Irish banks continue to offer some of the lowest interest rates in Europe, making it harder for savers to stay ahead of inflation

Raisin Bank offers a secure way to grow your savings with higher-yield accounts from across Europe — all managed through one free, easy-to-use platform

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Despite a recent pause in U.S. tariff activity, markets remain unpredictable. From central bank decisions to trade realignments and inflation concerns, the global picture is far from settled. For savers, this kind of environment calls for stable, low-risk strategies that can support broader diversification goals.

As a small, export-driven economy, Ireland feels the effects of global trade slowdowns quickly. Exports account for nearly half of our GDP, so when international demand falls, domestic growth follows.

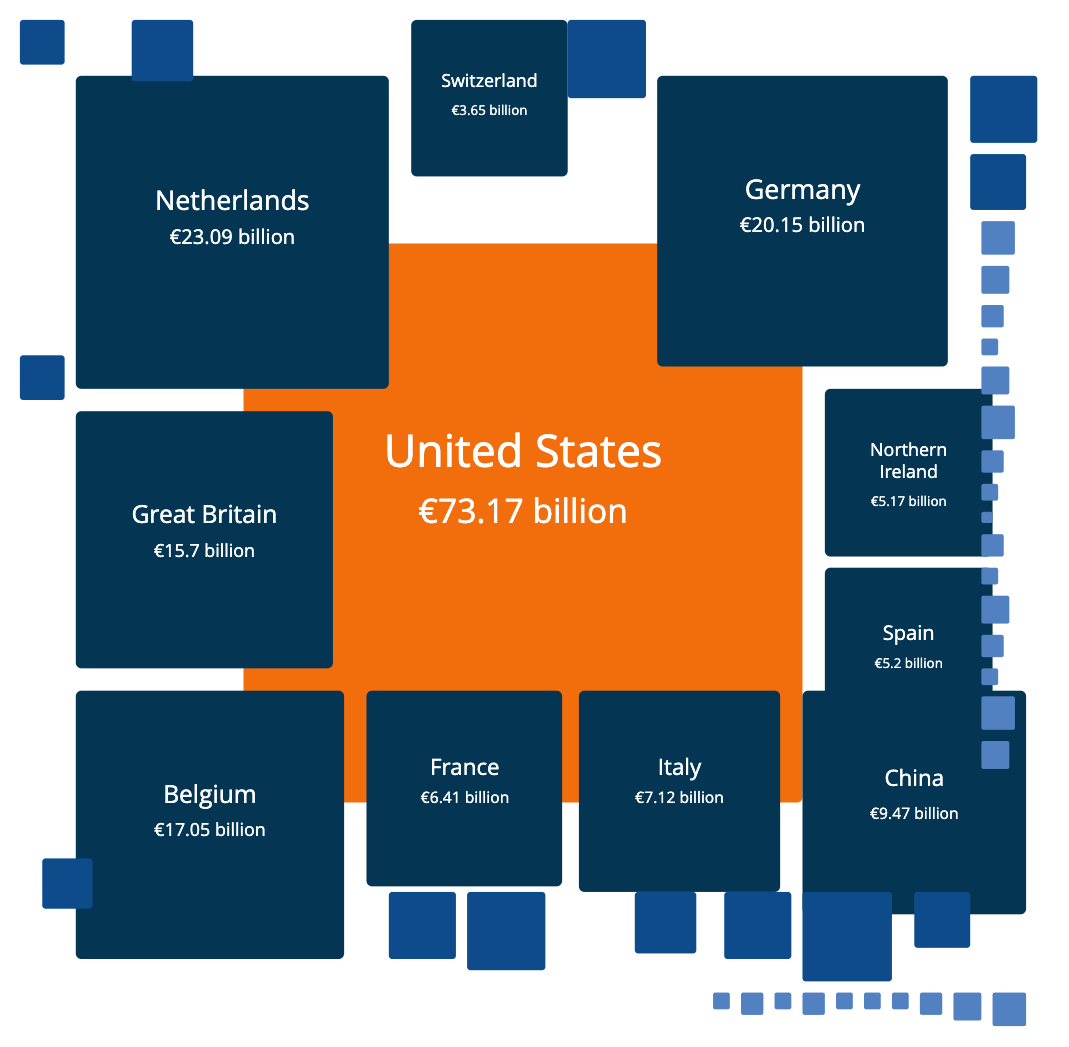

The US is Ireland’s single-biggest trading partner — it accounts for €73 billion of Irish goods exports last year, up by €19 billion on 2023.

Source: CSO

Periods of uncertainty often lead investors to seek liquidity and safety. But when Irish savings accounts offer less than 1% interest, inflation quietly erodes real value. Adding high-yield European savings to your portfolio can offer both stability and better returns — without market exposure.

Despite inflation and tighter markets, most Irish deposit accounts still pay below 1%. That might feel safe, but in real terms, it’s shrinking your money.

According to recent data, 97% of Irish household deposits are in current accounts, demand deposits or notice accounts paying 0.13% on average. Demand deposit accounts on our marketplace, meanwhile, pay up to 2.44% AER.

“In times of economic uncertainty and market volatility, it's more important than ever for Irish savers to make their money work harder. Leaving savings in low-interest accounts can mean your savings are losing value over time. Term deposits in particular offer a stable, secure way to earn higher interest, without market risk. Raisin.ie, gives Irish savers access to competitive deposit rates from banks across Europe, helping you protect and grow your savings with confidence.”

— Eoghan O’Hara, Country Head Ireland, Raisin Bank

Savers often prioritise security and access, and rightly so. But if liquidity comes with a near-zero return, it’s not protecting your wealth. It’s slowly draining it.

As an example, a saver with €50,000 in a typical Irish account at 0.5% would earn just €250/year — compared to €1,250 at 2.5%. Our top fixed term offering currently pays 2.76% AER.

Raisin Bank offers Irish savers access to over 100 savings accounts from trusted European institutions, and there’s no currency conversion — everything’s done in euros. With one account, you can compare, choose, and manage savings — all fee-free and online.

"Best Savings Provider" 2025

Featured on the CCPC Money Tools

Member of the Contact Centre Management Association (CCMA)

Raisin.ie in the media

Every deposit is protected up to €100,000 per bank, per depositor, under national EU deposit guarantee schemes — just as with Irish banks. Rest assured that your money is safe, even in turbulent times.

A recent report from the Central Bank of Ireland found that 90% of Irish household deposits are held in overnight, easy-access accounts — the highest rate in the Eurozone.

That strong preference for liquidity led to €800 million in lost interest in 2024 alone. This is money that could have been earned by choosing higher-interest options.

Despite the availability of better rates abroad, only 3% of deposits are currently placed with non-Irish banks. The message is clear: the opportunity is there — but most savers aren’t taking it.

Feature | Raisin Bank | Traditional Irish banks |

|---|---|---|

Interest rates | Up to 2.76% AER | Ranging from around 0.13% for demand deposits to higher rates of 2.5% or more for fixed term deposits |

Deposit guarantee | €100,000 per bank (EU-wide) | €100,000 per bank (Ireland) |

Account fees | €0 | May include maintenance or transaction fees, varying by institution |

Product choice | 100+ savings accounts, 25+ banks | Limited to the bank's own savings accounts |

Account setup | Fully online | Sometimes requires in-person visits to branches for account setup and management |

Create your Raisin Account online in minutes. No paperwork, no branch visits.

See all available products side by side, with minimum deposits from €1. Choose by rate, term, and flexibility.

✓ Rates up to 2.76% AER

✓ €100,000 protection per bank

✓ 25+ EU banks, fully regulated

✓ Manage everything online, for free

Yes. Your deposits with partner banks are protected up to €100,000 per bank under national EU schemes.

With demand deposit accounts, you can top up and withdraw whenever you like. For fixed term savings accounts, your money will be available after the term is up.

No. Raisin Bank does not charge any account or savings account fees.

You can register in just a few clicks.